12 GST service centres set up to make tax payment easy

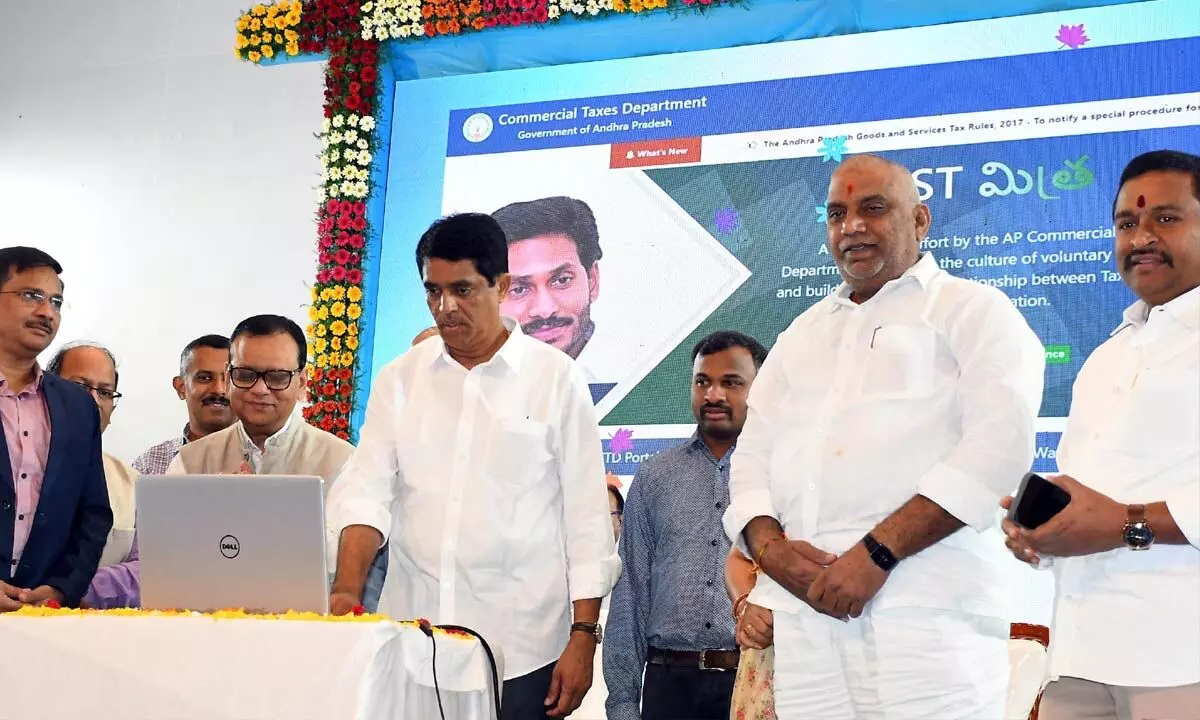

Minister for finance Buggana Rajendranath Reddy and other official releasing a Logo on Vision, mission and values of the commercial-tax department at Thummallapalli Kallakshetram in

Vijayawada on Monday. Photo: Ch Venkata Mastan

- FM Buggana says the move is aimed at make it easy for traders to pay taxes

- Releases GST Mitra logo, vision of commercial taxes dept along with officials

- Expresses satisfaction over the improvement in tax collection by 31% as against the 20% in TN and Kerala, 18% in Telangana

Vijayawada: The state commercial department had introduced new system in order to ease the tax payment system for the convenience of traders, said finance minister Buggana Rajendranath Reddy.

The minister along with adviser to chief minister Ajey Kallam, secretary of finance N Gulzar, customs and indirect taxes chief commissioner Sanjay Pant and other officials released the GST Mitra logo, Jnana Kshetram, vision of the commercial taxes department at Kshetraiah Kalakshetram here on Monday.

The minister said that tax-related services would be made easy with the registration of mobile number with the GST network. The finance minister also released a video regarding the function of GST Mitra.

The finance minister expressed satisfaction over the improvement in tax collection by 31 per cent as against the 20 per cent each in Tamil Nadu and Kerala, 18 per cent in Telangana, 17 per cent in Karnataka, and three per cent in Odisha. The GST collection up to November 2023 is Rs 21,180 crore which is 17.14 per cent more than last year’s corresponding period.

The state government set up 12 GST service centres across the state for the convenience of the traders and commerce communities. These centres, which exist in only three state in the country, would help easy payment of taxes. He expressed concern over the input tax evaders who are causing loss to the exchequer.

Rajendranath Reddy recalled the presentation on tax on tamarind in the 35th GST Council meeting in Goa. After much persuasion, the Centre agreed to remove the tax on tamarind.

Adviser to Chief Minister Ajey Kallam welcomed the transparency in the commercial tax department.

Finance secretary N Gulzar said that the department conducted a number of training programmes for making tax payment easy.

GSTN executive vice-president Dhiraj Rastogi, commercial tax chief commissioner Girija Shankar, Central taxes commissioner Sadhu Narasimha Reddy, Vijayawada Mayor Rayana Bhagyalakshmi, AP state planning commissioner vice-chairman Malladi Vishnu, West MLA Velampalli Srinivas, and several officials and auditors also participated.