Live

- AR SI Venkatramulu Honored by SP T. Srinivasa Rao, IPS Upon Voluntary Retirement

- Rally and Conference Held Demanding 3 Acres of Land for Landless Poor Labourers

- Ugadi Celebrations in Singapore: MP D.K. Aruna Graces the Event

- MLA Vijayudu Distributes CM Relief Fund Cheques in Alampur Constituency

- Congress Holds Key Meeting in Mahbubnagar, Leaders Plan Major Political Programs

- IPL 2025: Hardik returns as Mumbai Indians elect to bowl first against Gujarat Titans

- Purpose-Driven Data Engineering Impact

- Senior officers to act as mentors for students: Punjab CM

- CM Bhajan Lal Sharma distributes over 7,800 appointment letters; launches key education scheme

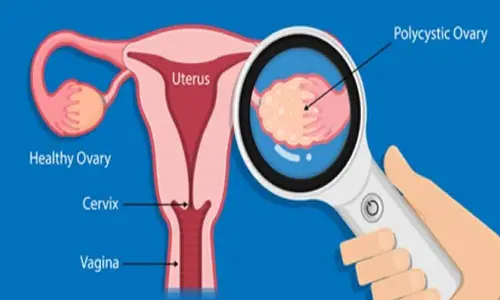

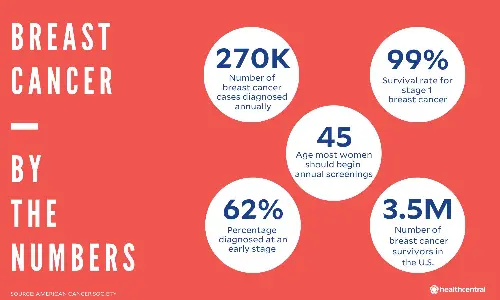

- India’s diagnostic imaging market to surpass $7 bn by 2033: Report